LECTURE AND SLIDE SHOW

REFERENCES

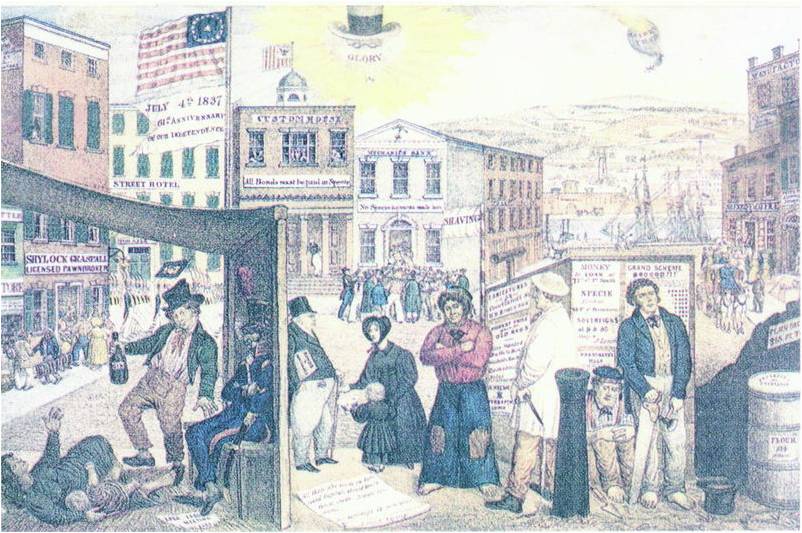

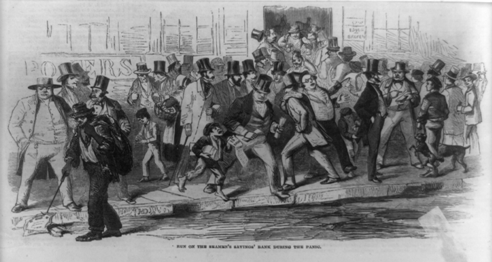

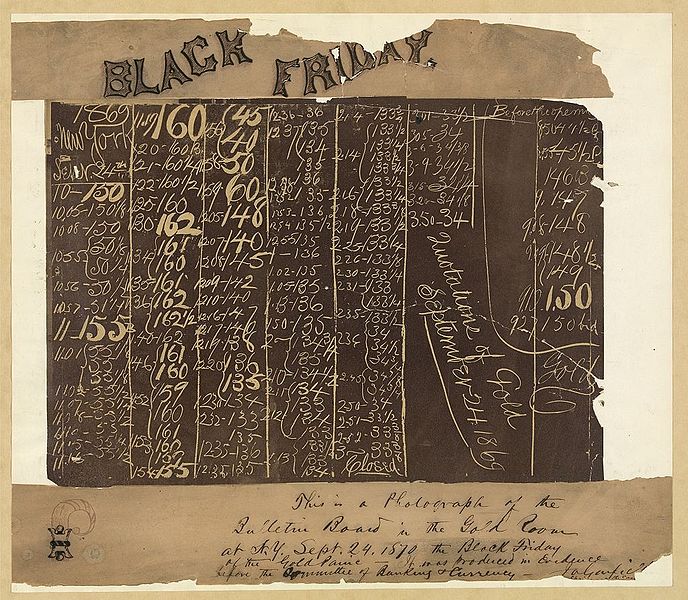

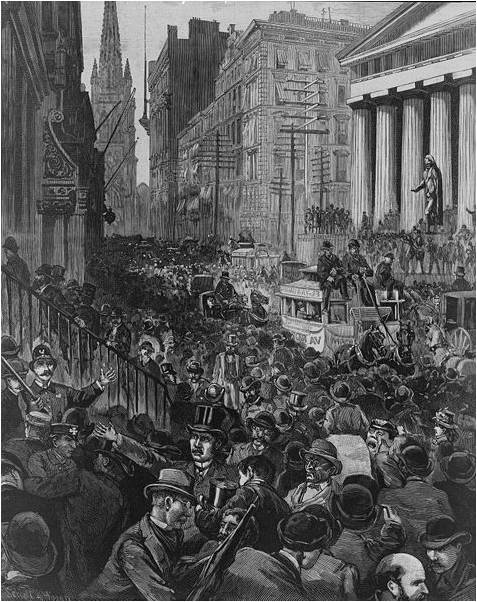

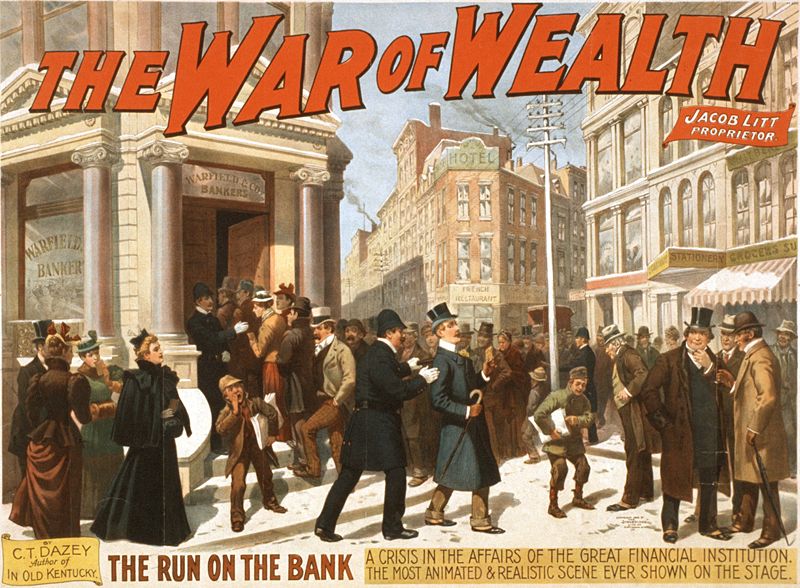

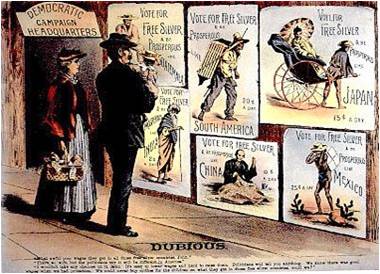

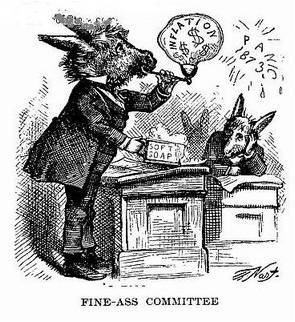

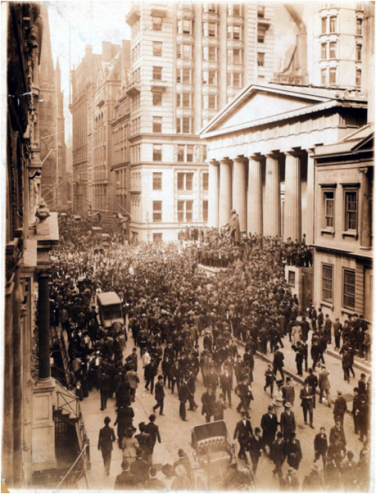

Description: New England folklorist and economic historian John Horrigan presents a chronology of recessions, bank crashes, slides, panics and manias in American finance including: The South Sea Bubble, The Mississippi Land Scheme, the Darien Scheme, The Financial Crisis of 1785, Canal Mania and Duer's Panic of 1792, The Panic of 1797, The Panic of 1807, The Panic of 1819, The Panic of 1825, The Jacksonian Financial Crisis of 1837, The Financial Crisis of 1847, The Western Blizzard Panic of 1857, The Financial Crisis of 1860, The Silver Panic of 1866, The Panic of 1869, The Panic of 1873, The Financial Crisis of 1878, Grant's Last Panic of 1884, The Panic of 1890, The Silver Panic of 1896, The Panic of 1901, The Panic of 1907, The Financial Crisis of 1920, The Crash of 1929, The Great Depression, The Panic of 1937, The 1953 Recession, The 1958 Recession, The Kennedy Slide of 1962, The Johnson Erosion of 1966, The 1967 Oil Embargo, The 1973 Oil Crisis, The 1979 Energy Crisis, The Recession of 1982-83, Black Monday (October 19, 1987), The Junk Bond Recession (1988-92), The Third Energy Crisis (1990), Black Wednesday (1992), The Mini Crash of October 27, 1997, The Slide of '98, The Dot Com Bubble (2001), The 9/11 Slide, The Emerging Markets Correction of May, 2006, The Great Stock Market Draw Down (August, 2007), The Grand Dow Slide of October 19, 2007, The Mortgage Crisis (2008) and The Great Humbling (2009 - 2012). Horrigan puts these economic troughs in a cyclical historical perspective and also equates them with their subsequent booms.

THIS LECTURE HAS BEEN PERFORMED FOR:

Running Time: 24 minutes (abridged - tape ends early) Size: 22 MB

Running Time: 1 hour and 18 minutes Size: 72 MB

ADDITIONAL AUDIO RECORDINGS:

THE DOW JONES INDUSTRIAL AVERAGE (May 26th, 1896)

Recorded on December 30th, 2006 at Watertown, Massachusetts. John reads a very concise history of the DJIA. In 1896, Charles Dow compiled a market index of 12 companies to determine the strength of the stock market and as a barometer of the American economy. It opened in 1896 at 40.94 before dipping to 28.48. Today it sits between 12,000 and 13,000. Running Time is 13 minutes and 23 seconds.

THE PANIC OF 1819

Recorded on January 15th, 2008 at Watertown, Massachusetts. John reads two summaries of the Panic of 1819 which resulted in widespread speculation, inflation and overpricing of commodities after the War of 1812. The unemployment rate in Philadelphia was 75%!

ADAM SMITH AND THE WEALTH OF NATIONS (1776)

Recorded on January 2nd, 2008 in Watertown, Massachusetts. John reads about Adam Smith's theory of "Laissez-Faire" (government hands-off) which gave birth to modern free capitalism. Running time 5 minutes and 55 seconds.

THE SOUTH SEA BUBBLE (1720)

Recorded on January 15th, 2008 in Boston, Massachusetts. John reads from Wikipedia about rampant speculation and unfettered investment in the South Sea Company in 1720 that artificially elevated its value before a sudden drawdown that saw speculators lose their entire investment.

THE PRICE REVOLUTION (1470 - 1620)

Recorded on December 22, 2008, in Watertown, Massachusetts. John reads about the Price Revolution (inflation) which was a consequence of the Conquistadors pouring gold and silver into a depleted European population's (the Black Death) economy. Time: 7 minutes and 9 seconds; 7 MB

THE GREAT PRICE DEBASEMENT (1470 - 1620)

Recorded on March 2nd, 2009, in Watertown, Massachusetts. John reads about the Great English Price Debasement during the reign of Henry VIII that saw inflation take hold while currency lost value. Time: 14 minutes and 8 seconds; 13 MB

RETURN TO JOHN HORRIGAN HISTORICAL LECTURES

JOHN'S AUDIO CATALOGUE